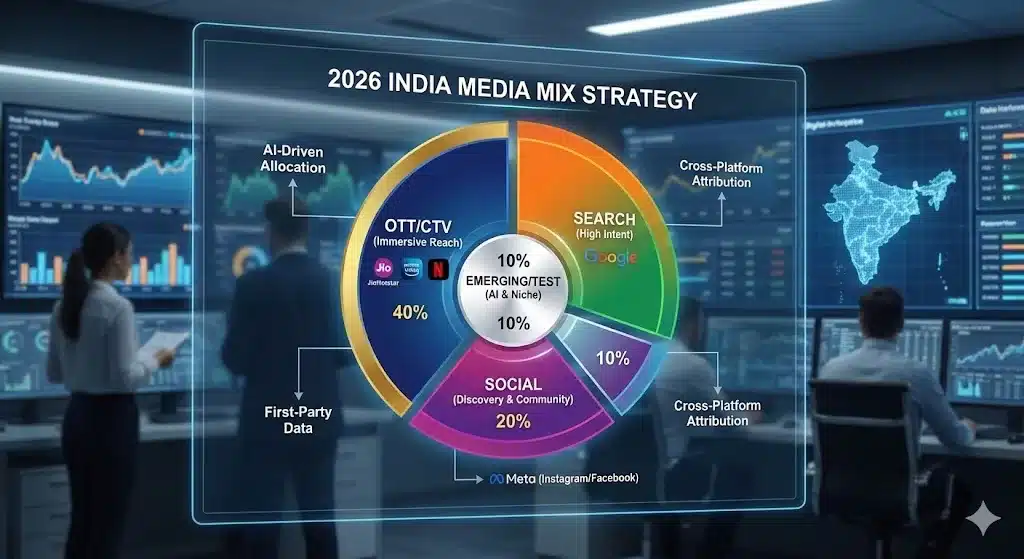

In 2026, the OTT Advertising in India is no longer a collection of “apps”—it is a Unified Intelligent Ecosystem. With the full operationalization of the JioHotstar and the arrival of Netflix’s (Incorporating generative AI into its existing ad-supported subscription plan), advertising on the “Big Screen” is more accessible, yet more complex, than ever before.

For modern marketers, the goal has evolved from simple “Reach” to “Attentive Immersion.”

1. OTT Advertising in India :Comparison Self-Serve vs. Managed Platforms

| Platform | Access Model | AI Edge in 2026 | Best For |

| Amazon DSP | Self-Serve | Predictive Cart-Matching: Targets users based on 24-hour purchase intent signals. | Performance & D2C Brands |

| JioHotstar | Managed / Semi | Dynamic Product Placement: AI overlays your brand into show scenes post-production. | Mass Reach & Sports (IPL Matches) |

| MNTN / Vibe.co | Self-Serve | Auto-Creative Refresh: Generates 50+ ad variations from 1 video to prevent viewer fatigue. | SMBs & Performance Testing |

| Netflix Ads | Managed | Sentiment Sync: Matches ad tone to the emotional arc of the movie. | Premium & Luxury Brands |

DSP, SSP, Ad Exchange, DMP, Ad Server are the terms used in programmatic Advertising. These topics are included in our upgraded Advanced digital Marketing Program. Also Learn platforms like Mountain & Vibe

2. The AI Revolution: How OTT Advertising in India is changing

Unlike 2024, where AI was a feature, in 2026, AI is the infrastructure of Indian OTT.

- Regional AI Dubbing & Lip-Sync: Hindi-language creative can now be “live-translated” into 12 Indian regional languages (Tamil, Bengali, Marathi, etc.) with perfect lip-syncing as the ad streams, removing the cost of 12 separate shoots.- You might have seen the famous kellogg’s muesli fruit and nut Ad by kajol & Tanuja.

- Predictive Ad Insertion: Platforms like YouTube CTV now use “Engagement Heatmaps” to predict when a viewer’s attention is highest, inserting your ad at that precise millisecond for 95% recall rates.

- Contextual AI Overlays: AI now “scans” the show content. If a character is drinking coffee, a “Starbucks” or “Blue Tokai” ad appears as a subtle, non-intrusive interactive banner on the side.

3. OTT vs. Google & Meta: The “Immersion” Difference

Why are Indian brands shifting 35% of their “Social & Search” budgets to OTT in 2026? It’s the difference between Interrupting and Immersing.

Google Ads (Demand Capture)

- The User State: “I have a problem and I need a solution now.”

- The Problem: High CPCs and “Search Blindness.”

- The Role: Final conversion.

Meta Ads (Demand Generation)

- The User State: “I’m scrolling to kill time.”

- The Problem: Creative fatigue and “Thumb-Stop” challenges.

- The Role: Social proof and community building.

OTT Advertising (Demand Immersion)

- The User State: “I am leaned-back, focused, and on the big screen.”

- The Advantage: In 2026, the “Cost Per Attentive Second” on OTT is lower than on Meta. On a 55-inch Smart TV, your brand isn’t a small thumbnail; it’s an experience. The completion rate for non-skippable OTT ads is nearly 98%, compared to <25% for social video.

4. The Strategic Pivot: When Should You Move to OTT?

Is your business ready for the Big Screen? Move to OTT if you hit these 2026 Saturation Triggers:

- The “Meta Ceiling”: Your Facebook/Instagram CAC (Customer Acquisition Cost) has plateaued. You’ve reached every user in the “Social Interest” bucket; you now need the “Broad Household” trust that only TV provides.

- The “Premium Signal” Requirement: You are selling high-ticket items (Real Estate, Luxury Cars, Premium Education). Appearing on Netflix or JioHotstar provides an “Authority Signal” that a mobile-only ad cannot replicate.

- The “First-Party Data” Play: You want to target users not by “interests” but by verified behaviors—like their Jio billing history or Amazon purchase data.

5. The 2026 Threaded Strategy: A 3-Stage Blueprint

To maximize ROI, your campaigns must “talk” to each other using Signal-Sharing (UID2.0) and Cross-Platform Retargeting.

Phase 1: The “Halo Effect” (OTT + Meta)

- The Workflow: Run a high-impact, 15-second “Experience” ad on JioHotstar or Amazon Prime Video targeting broad household demographics.

- The Thread: Simultaneously, run Meta Reels using the exact same visual assets and music.

- The Benefit: When a user sees your ad on their 55-inch TV (Leaned-back) and then sees it again on their phone (Leaned-forward), the Brand Recall increases by 65%. Meta’s AI recognizes the “Halo Effect” of the TV ad, lowering your CPMs on Instagram because the user is already “primed” to engage.

Phase 2: The “Search Capture” (OTT + Google)

- The Workflow: Most people do not click a link on their TV. They grab their phone and search your brand name on Google.

- The Thread: You must run a Google Brand Protection Campaign synced with your OTT flight times. If your OTT ad mentions a specific phrase (e.g., “India’s first AI-powered skincare”), bid heavily on that exact phrase on Google Search.

- The Benefit: You capture the high-intent traffic you generated on TV before a competitor can “piggyback” on your search volume.

Phase 3: The “Conversion Closer” (Meta + Google + OTT)

- The Workflow: Use Google Performance Max (P-Max) and Meta Advantage+ to retarget anyone who visited your site but didn’t buy.

- The Thread: Instead of a generic “Buy Now” ad, show them a 30-second “Deep-Dive” Video on YouTube CTV or a specialized OTT niche channel.

- The Benefit: This “Sequential Storytelling” reminds the user of the premium quality they saw in Phase 1, but provides the technical details (Google) and social proof (Meta) they need to finalize the purchase.

Strategic Decision Matrix: Budget allocation

| Trigger Situation | Strategic Action | Result in 2026 |

| High Search Volume but Low Trust | Increase OTT Spend by 20%. | Higher Conversion Rate on Search. |

| Meta CPA is Spiking | Shift 15% to Google P-Max using OTT video assets. | Lower Blended Customer Acquisition Cost (CAC). |

| Launching a New Category | Lead with OTT (60%) and Meta (40%) for 14 days before starting Search. | “Artificial Intent” creation that bypasses expensive keywords. |

Why This “Threaded” Approach in great?

- Lower Blended Customer acquisition Cost: By using OTT to build mass-market trust, your Meta and Google ads work harder. A “known” brand always gets cheaper clicks than an “unknown” one.

- Frequency Capping: In 2026, cross-platform tools allow you to say: “If the user saw the OTT ad twice, only show them the Meta ad once.” This prevents “Ad Fatigue” and saves budget.

- Data-Driven Attribution: You move from “Which platform worked?” to “Which sequence worked?” (e.g., OTT → Search → Meta → Buy).

OTT Media Mix Calculator

Step 1: Goal-Based allocation

| Business Goal | OTT Weight | Google/Search Weight | Meta/Social Weight |

| New Market Entry (Awareness) | 60% | 20% | 20% |

| Sustained Growth (Consideration) | 40% | 30% | 30% |

| Direct Response (Conversion) | 20% | 50% | 30% |

Step 2: The “Saturation Check” Formula

We use a Marginal ROAS Decay formula to decide when to move money to OTT:

IF (Meta_CPA > (1.3 * Goal_CPA)) AND (Search_Impression_Share > 85%) THEN Move 15% of total budget to Self-Serve OTT (Amazon/MNTN).

Example

Imagine you are running a campaign for a Premium Electric Scooter brand in India.

1. The Data Points (The “Before” Scenario)

- Goal CPA (Target): ₹2,000 per test ride booking.

- Meta Ads Performance: Your current CPA on Meta has jumped to ₹2,800.

- Google Search Performance: Your “Search Impression Share” is 88% for your top-performing keywords (e.g., “best electric scooter India”).

2. Applying the Formula Logic

- Condition A:

Meta_CPA > (1.3 * Goal_CPA)- Calculation: ₹1.3 \times 2,000 = ₹2,600.

- Since your Meta CPA is ₹2,800, you are effectively overpaying by more than 30%. This signals Ad Fatigue—you’ve shown your ad to the same people too many times.

- Condition B:

Search_Impression_Share > 85%- Since your share is 88%, you are already appearing for almost every relevant search. Adding more money here will not get you more sales; it will just increase your CPCs (Cost-Per-Click) because you’re bidding against yourself for the final 12% of the market.

3. The Execution: Move to OTT

“THEN Move 15% of total budget to Self-Serve OTT”

If your total monthly budget is ₹10 Lakh, you take ₹1.5 Lakh out of Meta and move it to Amazon DSP (Fire TV) or MNTN.

Final Implementation Checklist

- AI-Creative Readiness: Do you have the assets for AI-driven regional dubbing?

- Tracking Setup: Is UID2.0 or Amazon Attribution active to track TV-to-Mobile conversions?

- Regional Focus: “India” is not one market. Ensure your OTT media buy is split by state-tier clusters (e.g., Tier-2 Maharashtra vs. Tier-1 Karnataka).

What is the average CPM for OTT Advertising in India?

Standard programmatic CTV ads range from ₹300 to ₹550. High-impact placements (IPL, World Cup, Netflix Originals) range from ₹800 to ₹1,400 CPM.

Can I track sales from a TV ad to my website?

Yes. Using UID2.0 (Unified ID) and cross-device tracking, we can verify if a user who saw your ad on their Smart TV later made a purchase on their smartphone.

Do I need a professional film crew for creating OTT ads?

Not in 2026. Platforms like Amazon DSP and Google DV360 have integrated Generative AI tools that turn static product images into 4K-quality video ads with AI-voiceovers in minutes.